I have been doing startup investments for some time now. I had my fare share of mistakes in the process. Following is based on what I learned along the way and a short talk I have given recently. How to go about startup investment? What are the pitfalls? What about investing in markets like Bangladesh, Indonesia or similar emerging markets?

Following is based on that talk.

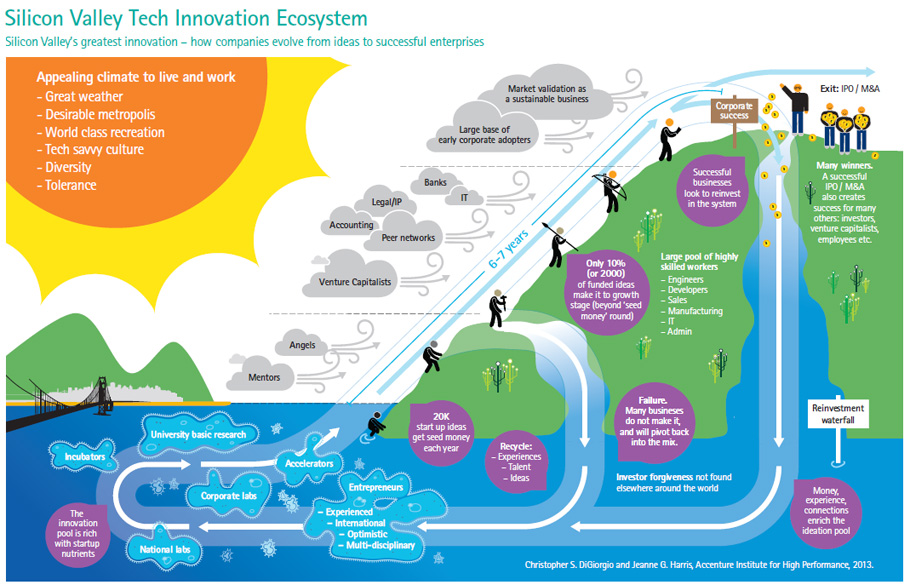

First, let us have a look at where Investment fits in in the whole startup ecosystem.

Accenture Institute for High performance came up with the above chart.

The journey starts when a founder comes up with an idea and form a company. Some founders go through different accelerator programs, organised independently or by corporates. Angels are the first outside money in the company. Around 20% of the startups get the initial funding in the form of seed/angels.

They get funding from more institutionalised VCs known as growth funds at later stage. Usually, 10% of the company end up getting growth funding. So, from 20k, around 2k ends up going to the next stage. The rest usually shuts down. Founders either join another company in the eco system or go back to start another startup. After a journey of 6/7 years or more, the founders may end up with a successful exit in the form of an IPO or acquisition. The successful founders than come back to the system as investors. Some start another company creating a virtuous cycle of growth. This is what makesSilicon Valley what it is today.

Couple of points to note here :

First, a small percentage of the startups end up in a successful exit…usually around 1% or less. Second, the eco system of Silicon Valley continues to strengthen by both successful and unsuccessful founders. Third, from idea to exit is a long journey and take anywhere between 6 to 10 years Fourth, investors like angels, seed, venture capitals and private equity play critical role at different stages of the company’s journey.

So, if you want to be a startup investor, you need to remember couple of things:

- Most of the investments will fail: As you have noticed, most of the companies end up as a failure. Similar will be the fate of most of your portfolio companies.

- This is illiquid: You are investing at a time frame of 6 to 10 years to get a return on your investment. Unlike an investment in a publicly traded stock, your money is locked up for a long time. You will have little option to “encash” your investment.

- Invest in companies you love: Given the long nature of the investment, this is like a marriage. Do not invest in companies where you do not believe the mission and the founder. You need to fall in love with both to survive the journey. Even then, like many marriages, you might not survive!

- Invest only what you are ready to lose: The investment will most likely fail and can not be sold. So, if you are planning to invest in this space, only do so assuming you will lose all your capital. Only put in a small part of your investable asset which will not hurt you if you end up losing the money. The thumb rule is 5% of your total investment portfolio may go into startups.

With the caveat about, here are four reasons why you should consider going into angel investing:

- Front row seat: Becoming an investor at a startup gives you a front row seat in the world of innovation and technology. You will have the opportunity to exchange ideas with a group of people who are often trying to change the way our world works. This is an extraordinary opportunity to get a peak of the future. Nothing else will provide you this level of exposure to the next 15/20 years.

- Return: The return can be zero in most of the cases. But if you do well, there will be companies that will provide you anywhere between 10~100x return on your capital. In rare cases, this may be even 1000x. It is assumed that people who invested at early stage of Uber may possible looking at a return of 3000x. So hypothetically, if you invested 1000 USD in Uber, you may be expecting a return of millions on that investment. But again, this is rare.

- Personal Growth: You get exposed to many startups across industries. This in turn will help improve your outlook and how to solve problems. One of the ways to be better at your business or your job is to be able to connect the dots. To be able to solve problems from abstract ideas. This way of problem solving is advocated by Charlie Munger, partner of Warren Buffet. Watch the following video..specially point 8. Though he was not an investor at startups, there are many similarities between the two investment approaches.

4. Contribute to the society : You have an opportunity to contribute to the direction of the startup. Unlike an investor at a publicly traded company, you can actually contribute in a meaningful way and contribute to the growth of the company. This may be in the form of helping the company to recruit, introducing to others in your network or may be even helping them in the strategy. You can contribute in a significant way and in turn contribute to the future of humanity!

If the above has convinced you, and you have the itch to go for it, here are some rules to follow:

- Build a portfolio: Do not invest as a one-off. Build a portfolio over time. You need to invest at 50 companies or higher to see a meaningful return on your investment. That of course does not mean you do a “Spread and Pray”. You do not randomly pick up a company to invest. Do your due diligence and and invest over time to build the portfolio.

- Follow the “experts”: Connect with people who have already done it. Your first 10/15 investments will most likely be wrong. Angel investment requires certain level of understanding. Understanding of technology trends, founder motivation and industry view etc.. One picks up these understanding and qualities over time. Try to invest together with people who have done this before. They have learnt from their mistakes. This will help to avoid some, not all, of your mistakes.

- Industry focus: It is not absolute but it helps to focus on industries where you already know the challenges. So, if you are a banker, you know the challenges in financial services. It is better to stick to companies that are working to disrupt this industry. The same goes for Health or FMCG sector.

- Enjoy the process: Remember the whole “marriage” thing, well, do learn to enjoy the process. The nature of the beast is that you will get the bad news first. The companies that fail, usually fail in the first few years. The companies that succeed, usually generate a return after 6/7 years. So, unless you enjoy the process of learning and interacting with founders, you will get frustrated too soon. Enjoy the process.

How about Bangladesh? Or for that matter other early stage emerging markets.

- Not matured: Bangladesh startup investment landscape is still at early stage. There are a few angel investors and hardly any meaningful late stage investors. This means the risk of investment is higher. On the same token, the valuation is relatively low. For successful companies, the return multiple will therefore be significantly better.

- Demographic dividend: These emerging markets have all the right indicators of positive demographic dividends. From age of population to internet penetration. All the indices are moving in the right direction. The domestic market itself provides a significant opportunity. Startups working in this space are trying solve some of the basic problems in the society. If successful, they will provide a strong return.

- Next Billion: If you look at internet penetration, it first happened in developed markets. As a result, larger companies which have gone on to claim Billion dollar valuations have come from those economies. The next billions of internet users are coming from countries like China, India, Indonesia and Bangladesh. The next wave of Billion dollar companies will likely to come from these markets.

- Regulatory environment: This is evolving. There seems to be a recognition by regulators about the importance of startups in most of these markets. The regulators are positive and putting in place the right regulations to help the startups.

Startup investment is an exciting space and rewarding in many ways. If you do want to get in, follow the rules mentioned above.